Blockchain and Distributed Ledger Technology

Marketing, Technology 10 min reading

Content

Show-

What is Distributed Ledger Technology (DLT)?

- Some of the types of DLT

-

What Is a Ledger in Crypto?

- The General Purpose of a Crypto Ledger

-

How Cryptocurrency Public Ledgers Work

- Verifying Transaction Details

- Cryptocurrency Transactions on the Public Ledger

- Risks of Public Ledger-Based Cryptocurrencies

- How to Keep Your Crypto Assets Secure

- Conclusion

Explore more from Velas

Technology 1 min reading

Velas Expands Cross-Chain Bridging to AvalancheExciting news for the Velas community! We're thrilled to announce that Velas has extended its cross-chain interoperability by enabling bridging to Avalanche, a prominent blockchain platform known for its high throughput and low fees.

Technology, Engineering 1 min reading

Smart Contracts on SteroidsWelcome to the latest edition in our series, Exploring Velas' Innovative Technologies. Throughout this series, we delve into the cutting-edge technologies propelling Velas forward as a leading blockchain platform, reshaping the landscape...

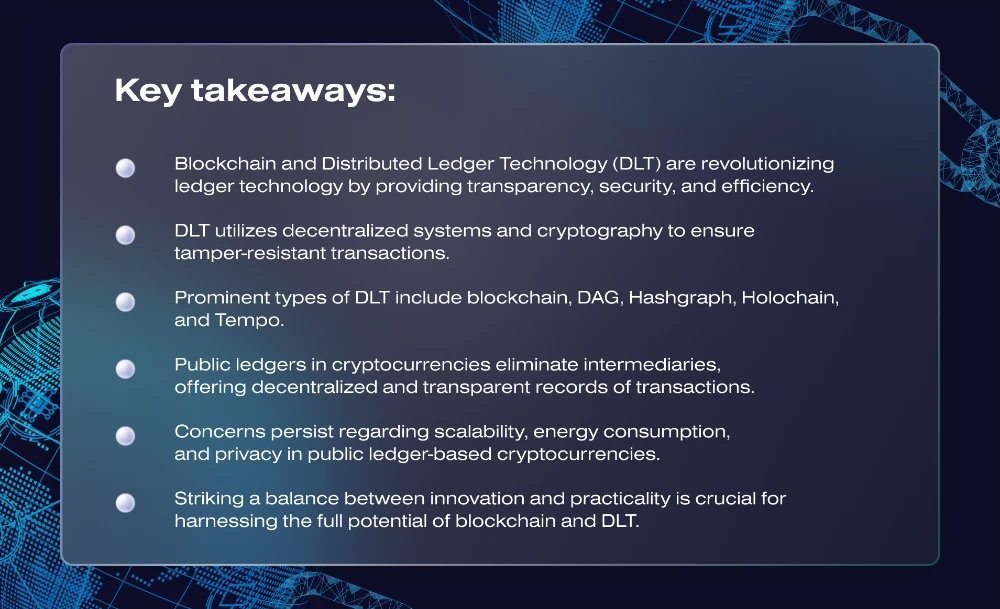

Blockchain and Distributed Ledger Technology (DLT) have emerged as revolutionary advancements in the field of ledger technology, promising increased transparency, security, and efficiency across various industries. While the concept of a ledger has been around for centuries, blockchain introduces a new paradigm that challenges traditional notions of record-keeping and data management.

The global blockchain distributed ledger market experienced significant growth, reaching $14.47 billion in 2023 from $8.85 billion in 2022, with a compound annual growth rate (CAGR) of 63.5%. However, the Russia-Ukraine war disrupted global economic recovery from the COVID-19 pandemic, resulting in economic sanctions, commodity price surges, supply chain disruptions, and inflation. Despite these challenges, the blockchain distributed ledger market is projected to reach $102.61 billion in 2027, maintaining a CAGR of 63.2%.

With 2023 statistics and forecasts pointing towards exponential growth in the adoption of these technologies, it is crucial to delve into their workings and potential impact.

What is Distributed Ledger Technology (DLT)?

Distributed Ledger Technology (DLT) is a digital system for recording and verifying transactions across multiple participants or nodes. Unlike a centralized ledger, which relies on a single trusted entity for record-keeping, DLT distributes the ledger across a network of computers, enabling transparency, resilience, and trust. By utilizing cryptographic techniques, DLT ensures the integrity and security of data, making it tamper-resistant and immutable.

DLT has garnered attention for its potential applications in a wide range of industries, including banking, finance, energy, healthcare, governance, supply chain management, and more. By leveraging its core features, DLT offers opportunities for streamlined processes, cost reduction, increased efficiency, and enhanced security.

Some of the types of DLT

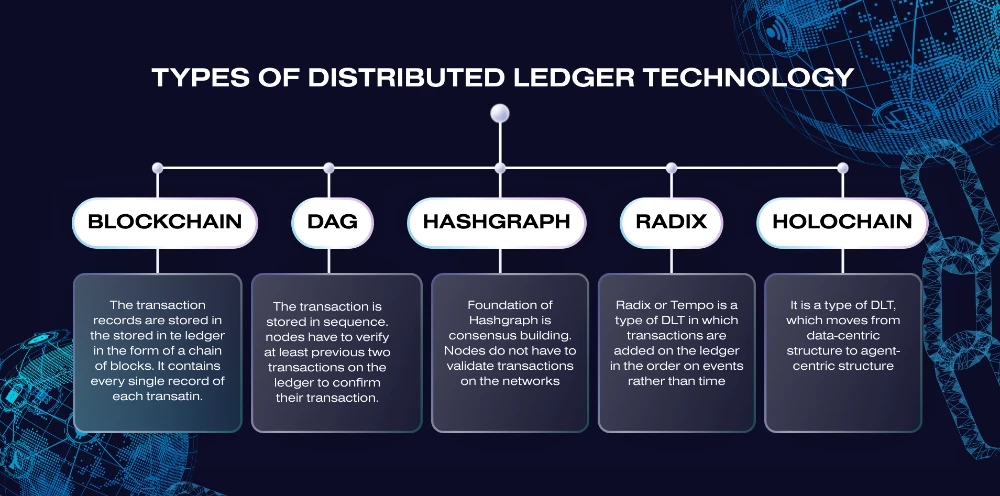

DLT encompasses various types, each with its unique characteristics and use cases. Here are five prominent types of DLT:

- Blockchain: This is perhaps the most well-known form of DLT, characterized by a chain of blocks containing transactional data. Each block is linked to the previous one, forming an unalterable and transparent record of transactions. Blockchain finds applications in cryptocurrency, supply chain management, smart contracts, and more.

- Directed Acyclic Graph (DAG): DAG is a data structure that diverges from the linear structure of a blockchain. Instead of a sequential chain of blocks, DAG employs a more complex network of interconnected transactions. DAG-based systems, such as IOTA, offer scalability, high throughput, and low transaction fees.

- Hashgraph: Hashgraph utilizes a consensus algorithm that relies on a voting mechanism among nodes to achieve distributed consensus. It offers high transaction throughput, low latency, and strong security. Hashgraph has found applications in areas like decentralized finance (DeFi) and online gaming.

- Holochain: Holochain takes a unique approach by focusing on distributed application architecture rather than a traditional ledger. It enables the creation of peer-to-peer applications that can operate independently while maintaining data integrity and security. Holochain aims to empower individuals with ownership and control over their data.

- Tempo or Radix: Tempo (formerly known as Radix) introduces a new form of DLT called Cerberus, which combines the best features of DAG and blockchain. Cerberus aims to address the scalability limitations of existing DLT platforms while maintaining security and decentralization.

While blockchain remains the most prevalent form of DLT nowadays, these alternative approaches demonstrate the evolving landscape of ledger technology and highlight the diversity of solutions available.

“Blockchain and DLT have the potential to transform industries by providing a trustless, decentralized, and secure infrastructure for data management. With the ability to streamline processes, reduce costs, and enhance transparency, these technologies are poised to revolutionize the way we conduct business.”

As blockchain and DLT continue to mature and gain traction across industries, their impact on the global economy and society at large cannot be understated. With a keen eye on technological developments and their implications, we must navigate the evolving landscape of ledger technology with cautious optimism.

What Is a Ledger in Crypto?

At its core, a ledger in the context of cryptocurrencies serves as a decentralized, immutable record of all financial interactions within a particular network. However, the emergence of blockchain and distributed ledger technology (DLT) has revolutionized the way we perceive and utilize these ledgers, taking transparency and security to unprecedented levels.

While traditional ledgers have long been associated with centralized institutions, such as banks, a public ledger in the realm of cryptocurrencies operates on an entirely different principle. Rather than relying on a single trusted authority, a public ledger leverages the power of decentralized networks, where thousands of nodes work collectively to verify and validate transactions. This distributed approach ensures transparency and removes the need for intermediaries, empowering individuals and fostering trust in the digital realm.

The General Purpose of a Crypto Ledger

The primary objective of a crypto ledger is twofold: to record every transaction in a transparent manner and to prevent double-spending or fraudulent activities. Through the use of complex cryptographic algorithms, a crypto ledger ensures the integrity and security of transactions, safeguarding against malicious actors and maintaining the accuracy of the network.

“Blockchain and DLT have revolutionized the concept of ledgers by introducing decentralized and tamper-resistant systems. These technologies offer a secure and transparent infrastructure for recording transactions, providing immense potential for streamlining various industries.”

How Cryptocurrency Public Ledgers Work

To comprehend the workings of a cryptocurrency public ledger, let's delve into a simplified analogy. Imagine you have a $10 bill in your possession, and you want to digitally transfer it to a friend, Alex. In the traditional banking system, a centralized ledger would be updated by the bank to reflect this transfer. However, in the world of cryptocurrencies, the process follows a different path.

When you initiate the transfer, the network of nodes—computers that collectively maintain the ledger—verifies and validates the transaction. This validation ensures that you indeed possess the $10 bill and haven't already spent it. Once approved, the transaction is bundled with others into a block. This block is then added to the existing chain of blocks, forming a permanent and immutable record of the transaction.

This decentralized and transparent nature of public ledgers empowers individuals with direct control over their finances and eliminates the need for intermediaries. It also enhances security by making the ledger resistant to tampering and fraud, as every transaction is cryptographically linked to previous ones.

While the potential of blockchain and DLT in revolutionizing ledgers and transforming industries is widely acknowledged, critics argue that the energy consumption and scalability challenges associated with these technologies must be addressed. As one skeptic cautions, "While the concept of a decentralized ledger is intriguing, the practical limitations surrounding energy usage and scalability may hinder widespread adoption."

As the world continues to explore the possibilities of blockchain and DLT, their impact on finance, supply chain management, healthcare, and other sectors is undeniable. Striking the delicate balance between innovation and practicality will determine how these ledger technologies shape our future.

Verifying Transaction Details

Blockchain, the driving force behind DLT, operates on the principle of a public ledger—a digital record of transactions that is distributed across a network of computers. Every transaction, whether financial or non-financial, is verified and recorded on this open and transparent ledger.

The public ledger ensures that each transaction is authenticated by a network of participants, preventing any single entity from tampering with the records. This increased level of transparency not only engenders trust but also enables real-time auditing and validation. With every transaction etched indelibly into the blockchain, a comprehensive and immutable history of exchanges is established. This empowers individuals and businesses alike with an unparalleled degree of certainty and accountability.

Cryptocurrency Transactions on the Public Ledger

One of the most significant applications of blockchain technology is in the realm of cryptocurrencies. With digital currencies like Bitcoin and Ethereum gaining widespread acceptance, the public ledger plays a pivotal role in recording and verifying cryptocurrency transactions. Every time a crypto transaction occurs, it is logged on the blockchain, leaving an indelible mark that can be traced and audited.

By leveraging the transparency and security provided by the public ledger, cryptocurrencies offer a decentralized alternative to traditional financial systems.

“Cryptocurrency transactions on the public ledger eliminate the need for intermediaries, reducing costs and increasing the efficiency of financial transactions.”

Moreover, the public nature of the ledger ensures that the integrity of cryptocurrency transactions remains intact. Every participant in the network has access to the transaction history, which prevents fraud, double-spending, and other illicit activities. This robustness, combined with the tamper-proof nature of the blockchain, instills confidence and credibility in the cryptocurrency ecosystem.

Risks of Public Ledger-Based Cryptocurrencies

While blockchain and DLT offer undeniable advantages, critics raise concerns about the risks associated with public ledger-based cryptocurrencies. The primary contention revolves around privacy and confidentiality. As transactions are visible to all participants, some argue that this level of transparency may compromise the privacy of individuals and businesses.

As the world embraces the power of blockchain and DLT, the public ledger becomes the bedrock of trust, offering unparalleled security and transparency. However, ongoing discussions around privacy and the need for regulatory frameworks highlight the dynamic nature of this technological revolution. As the industry evolves, striking the right balance between openness and confidentiality will remain crucial in using the full potential of these transformative technologies.

How to Keep Your Crypto Assets Secure

In an era where digital assets are gaining unprecedented popularity, ensuring the security of one's cryptocurrency holdings has become paramount. With cyber threats lurking around every virtual corner, individuals and businesses alike are seeking reliable solutions to safeguard their valuable assets. Fortunately, there are steps one can take to mitigate risks and maintain the integrity of their crypto holdings.

Experts recommend adopting a multi-layered security approach. This includes employing strong and unique passwords, utilizing two-factor authentication (2FA), and staying vigilant against phishing attempts. Additionally, storing cryptocurrencies in secure wallets is crucial for safeguarding against potential breaches and hacks.

When it comes to securing your valuable crypto assets, one option stands out as a beacon of trustworthiness and reliability: the Ledger Live Wallet. As part of its ongoing commitment to providing maximum security for its community, Velas, a leading blockchain project, has recently integrated its native VLX token with the Ledger Wallet. This integration marks a significant step forward in ensuring the safety and protection of VLX holders.

The Ledger Wallet is widely regarded as one of the most secure hardware wallets on the market. With its offline storage and advanced cryptographic features, it provides a fortress-like barrier against unauthorized access. By leveraging this state-of-the-art solution, VLX holders can enjoy peace of mind knowing that their assets are shielded by the highest levels of security.

“At Velas, we prioritize the security and well-being of our community members. By integrating the VLX token with the Ledger Wallet, we are empowering our users to confidently store and manage their assets while benefiting from the industry-leading security measures provided by Ledger.”

While critics may argue that centralized points of failure exist even within hardware wallets, proponents of the Ledger Wallet highlight its track record and the rigorous testing it undergoes to ensure the highest standards of security.

Footnote

To get started, simply download the Ledger app and begin managing your VLX coins. Please note that at present, VLX integration is available only in staging and test networks. Select the appropriate network accordingly when using the integration.

We would like to provide a few important points for users planning to interact with Ledger and any Web3 dApp:

- Ensure your Ledger device is unlocked and the Ethereum app is installed and opened.

- To interact with safe contracts, enable blind signing and other necessary settings (except debug) in the Ledger device's Ethereum app settings.

- In case of a USB error, disconnect and reconnect your device to resolve any connection issues.

By following these steps, your Ledger device will function seamlessly in the mainnet and production environments, enabling you to securely manage your VLX coins.

Conclusion

In conclusion, DLT, including blockchain and its alternatives, has already laid the foundation for a decentralized and tamper-resistant future. The ongoing advancements and the increasing adoption of DLT across industries pave the way for a more efficient, secure, and transparent global economy. By considering practical limitations and proactively addressing concerns, we can unlock the full potential of DLT and leverage its transformative power to shape the future of business and society as a whole.