Transforming the Payment Sector with Blockchain Technology

Marketing, Technology 9 min reading

Content

Show- Key Issues in the Payment Sector: A Never-Ending Battle

- The Fairy Tale of JPMorgan Chase & Co.: Accelerating Interbank Payments

- How Blockchain for Payments Works

-

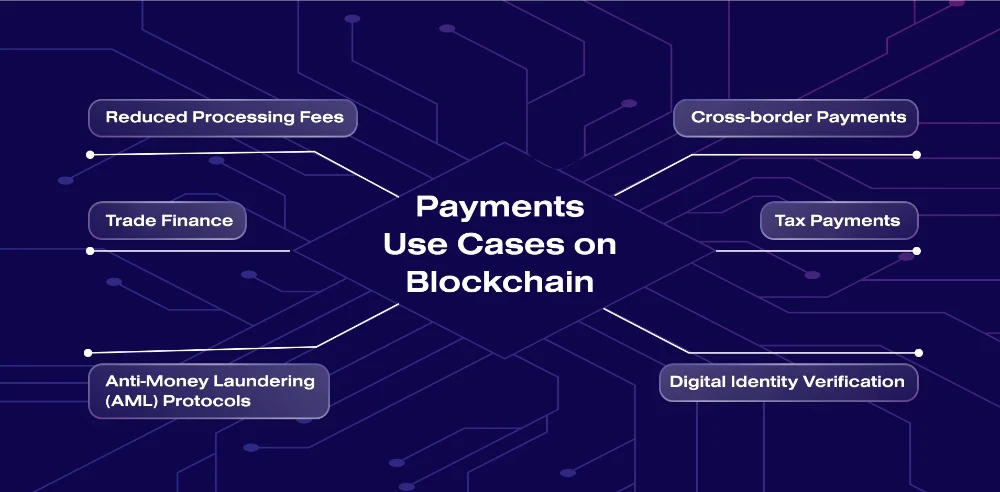

Payments Use Cases on Blockchain

- Cross-border Payments

- Digital Identity Verification

- Tax Payments

- Reduced Processing Fees

- Trade Finance

- Anti-Money Laundering (AML) Protocols

- Is Velas a good base for Payment Projects?

- Conclusion

Explore more from Velas

Technology 1 min reading

Velas Expands Cross-Chain Bridging to AvalancheExciting news for the Velas community! We're thrilled to announce that Velas has extended its cross-chain interoperability by enabling bridging to Avalanche, a prominent blockchain platform known for its high throughput and low fees.

Technology, Engineering 1 min reading

Smart Contracts on SteroidsWelcome to the latest edition in our series, Exploring Velas' Innovative Technologies. Throughout this series, we delve into the cutting-edge technologies propelling Velas forward as a leading blockchain platform, reshaping the landscape...

Blockchain technology has brought about transformative changes in various industries, and the payment sector is no exception. As the largest segment utilizing blockchain, payments have been revolutionized, offering enhanced security, transparency, and efficiency. The integration of blockchain technology has addressed key challenges that have long plagued the payment sector, providing a promising solution for businesses and consumers.

In recent years, the global crypto payment gateway market has witnessed remarkable growth. Valued at $1 billion in 2021, it is projected to reach a staggering $5.4 billion by 2031, growing at a remarkable CAGR of 18.7% from 2022 to 2031. This exponential growth is driven by various factors, including the increasing adoption of artificial intelligence into mobile applications and the need for innovative solutions during the pandemic.

Key Issues in the Payment Sector: A Never-Ending Battle

For years, the payment sector has been locked in a battle between two contrasting forces - the centralized and the decentralized. Similar to the well-known feud between tech giants Elon Musk and Mark Zuckerberg, the payment industry has grappled with its own conflicts and challenges.These key issues include:

- Payment Frauds and Chargebacks: The rise in payment thefts and fraudulent activities has posed significant challenges for the payment ecosystem. Cybercriminals exploit vulnerabilities in traditional payment systems, leading to financial losses for businesses and consumers. The process of chargebacks, often based on illegitimate claims, further burdens businesses and erodes trust.

- Delayed Cross-Border Transactions: The complex network of intermediaries involved in cross-border transactions has resulted in prolonged processing times. In an era that demands instant global connectivity, these delays can have detrimental effects on businesses and individuals. Missed deadlines, financial losses, and hindered economic growth are common consequences of inefficient cross-border payment systems.

- High Transaction Fees: Traditional payment systems heavily rely on intermediaries and centralized entities, leading to high transaction fees. These fees impact both merchants and consumers, restricting financial inclusion and impeding economic growth.

- Low Private Data Security: The centralized storage of sensitive payment information exposes individuals and businesses to data breaches and identity theft. The need for a more secure and privacy-focused payment ecosystem has become paramount in the face of rising cybersecurity threats.

- KYC Abuse and Repetitive Procedures: The Know Your Customer (KYC) procedures, while crucial for identity verification, often result in redundant processes across different payment providers. Customers are burdened with repeatedly submitting personal information, which increases the risk of data exposure and privacy infringements.

Addressing these challenges requires a transformative approach in the payment sector. Blockchain technology, with its inherent security, transparency, and efficiency, offers a potential solution that prioritizes the needs of businesses and consumers alike.

The Fairy Tale of JPMorgan Chase & Co.: Accelerating Interbank Payments

In a remarkable success story, JPMorgan Chase & Co. has harnessed the power of blockchain technology to revolutionize interbank payments. Collaborating with Royal Bank of Canada and ANZ, JPMorgan Chase & Co. introduced the Interbank Information Network (IIN) in 2017. This pioneering interbank payment platform leveraged blockchain technology to streamline payment transactions and enhance the management of financial documents.

The impact of the IIN has been truly transformative. By leveraging blockchain and smart-contract-based automation, JPMorgan Chase & Co. witnessed a drastic reduction in bank transfer processing time. The average processing time, which previously took three days, was reduced to a mere one hour. Furthermore, the fees associated with cross-border transactions experienced a significant drop, decreasing from 5-30% to just 2-3%. This reduction in transaction costs resulted in substantial operational cost savings for the bank.

Farkhad Shagulyamov, the CEO of Velas, a prominent blockchain company, emphasizes the significance of blockchain technology in revolutionizing payment systems. He states,

“Blockchain technology offers unprecedented security, speed, and cost-efficiency, paving the way for a new era of financial transactions.”

The success of JPMorgan Chase & Co. exemplifies the immense potential of blockchain technology in transforming the payment sector. By adopting blockchain-based solutions, businesses and consumers can benefit from secure, efficient, and cost-effective payment processing.

How Blockchain for Payments Works

Traditional payment systems heavily rely on centralized authorities, such as banks and financial institutions, to facilitate transactions. However, these centralized systems are susceptible to security breaches, costly intermediaries, and delays in processing. Blockchain technology offers an alternative approach by leveraging a decentralized network of computers to validate and record transactions securely.

In a blockchain-based payment system, transactions are verified and added to a digital ledger, known as a blockchain, through a consensus mechanism. Each transaction is represented by a block containing relevant information, such as the sender, recipient, amount, and timestamp. These blocks are then linked together in a chronological order, creating an immutable chain of transaction records.

As an example, let's consider a scenario where a customer wants to make an online purchase using cryptocurrency, such as Velas (VLX). The payment process on the blockchain would involve the following steps:

- The customer initiates the payment by sending the specified amount of VLX to the merchant's wallet address.

- The transaction request is broadcasted to the blockchain network, where multiple nodes (computers) validate the transaction's authenticity and verify the available funds.

- Once the transaction is validated, it is added to a new block in the blockchain and linked to the previous blocks, forming a secure and transparent transaction history.

- The merchant receives the VLX payment in near real-time, eliminating the need for intermediaries and reducing transaction costs.

- The merchant can choose to either hold the received cryptocurrency or convert it into a fiat currency of their choice using cryptocurrency exchanges or payment gateways.

Payments Use Cases on Blockchain

The potential use cases of blockchain for payments extend far beyond simple peer-to-peer transactions. Let's explore some of the key areas where blockchain technology is making significant strides:

Cross-border Payments

Cross-border transactions often face challenges such as high fees, lengthy processing times, and currency exchange complexities. Blockchain technology streamlines these payments by removing intermediaries and enabling direct peer-to-peer transfers. The decentralized nature of blockchain eliminates the need for traditional correspondent banks, resulting in faster and more cost-effective cross-border payments.

Digital Identity Verification

Blockchain provides a secure and decentralized platform for digital identity verification. By leveraging blockchain's immutable ledger, individuals can have greater control over their personal information while ensuring its privacy and security. Blockchain-based digital identity solutions offer faster and more reliable verification processes, reducing the risks of identity theft and fraud.

Tax Payments

Blockchain technology simplifies and automates tax payment processes. By storing tax-related data on the blockchain, governments can streamline tax collection, enhance transparency, and reduce fraudulent activities. Immutable records of taxable amounts, supporting documents, and tax payment transactions ensure consistent and compliant tax reporting under different jurisdictions.

Reduced Processing Fees

One of the notable advantages of blockchain-based payments is the reduction in processing fees. Traditional payment systems often involve intermediaries that charge significant fees for their services. With blockchain, transaction fees can be significantly lower, especially in networks like Velas (VLX), where fees are kept at ultra-low levels, almost zero. This reduction in fees benefits both businesses and consumers, making payments more affordable and attractive.

Trade Finance

Blockchain technology is transforming trade finance by digitizing and streamlining processes such as letters of credit, bill of lading, and supply chain financing. By leveraging smart contracts, trade finance on the blockchain enables automated and secure payment enforcement, ensuring timely fulfillment of agreements and minimizing payment delays.

Anti-Money Laundering (AML) Protocols

Blockchain offers robust solutions for anti-money laundering (AML) protocols. By maintaining an immutable record of transactions on the blockchain, it becomes easier to track and identify suspicious activities. Blockchain-based AML protocols enhance transparency, strengthen compliance, and contribute to the overall integrity of the financial system.

Farkhad Shagulyamov, the CEO of Velas, emphasizes the potential of blockchain for payments, stating,

“Blockchain technology has the power to revolutionize the payments landscape by providing faster, more secure, and cost-effective solutions. With Velas (VLX) as an example, we aim to offer ultra-low transaction fees, making blockchain-based payments accessible and affordable for businesses and consumers worldwide.”

As blockchain technology continues to advance, the potential for innovation and disruption in the payments industry grows. From cross-border transactions to digital identity verification and reduced processing fees, blockchain is poised to reshape the way we make payments, offering unprecedented efficiency, security, and transparency.

As the world embraces the transformative power of blockchain, businesses and consumers are set to benefit from a new era of payment solutions that redefine the way we exchange value in the digital age.

Is Velas a good base for Payment Projects?

Leading the charge in this transformative movement is Velas, a cutting-edge blockchain platform known for its advanced features and unrivaled capabilities. With its lightning-fast transaction fees, high throughput, and robust security protocols, Velas stands at the forefront of the decentralized finance world.

“We believe that blockchain technology has the power to revolutionize the Payments industry. At Velas, we are committed to providing a secure, efficient, and scalable blockchain platform that empowers businesses and individuals to conduct seamless payment transactions.”

Velas offers unparalleled transaction speed, processing thousands of transactions per second, far surpassing traditional payment systems. With near-instant confirmation and settlement, payments can be completed within seconds, eliminating the frustrating delays associated with legacy payment methods.

Conclusion

In conclusion, the Payments industry is on the cusp of a transformative era, fueled by the potential of blockchain technology. As businesses and consumers seek faster, more secure, and cost-effective payment solutions, blockchain emerges as a promising solution to address these pressing needs.

While the Payment sector still faces challenges such as payment frauds, delayed cross-border transactions, high transaction fees, low data security, and repetitive procedures, blockchain technology presents an opportunity to overcome these hurdles. The success story of JPMorgan Chase & Co. showcases the immense potential of blockchain in transforming interbank payments, reducing processing times, and lowering fees2.

Blockchain technology, with its inherent security, transparency, and efficiency, offers the potential to revolutionize the way we conduct financial transactions. Velas, with its remarkable transaction speed, security features, and scalability, stands as a beacon of innovation in the blockchain space. By leveraging Velas' advanced capabilities, businesses can unlock the potential of seamless payment processing, reducing costs, improving efficiency, and enhancing customer experiences.

As the Payments industry embraces blockchain, it sets the stage for a new era of frictionless, secure, and efficient financial transactions. With the remarkable growth and potential of blockchain for payments, the world is witnessing the birth of a new era in global finance.

Stay ahead of the curve

Add your email to get hand-tailored messages only. We say no to boring newsletters and spam!