Velas vs Solana: Features, Capabilities, and Differences

Marketing, Technology 5 min reading

Content

Show- Protocol Differences:

- Smart Contracts:

- Common Development Tools:

- Deployment and Testing Framework:

- Wallets:

- Front End Tools:

- Security Analysis:

- DeFi Building Blocks:

- Automated Market Makers:

- Bridges:

- How will the Velas team help you migrate to Velas?

Explore more from Velas

Technology 1 min reading

Velas Expands Cross-Chain Bridging to AvalancheExciting news for the Velas community! We're thrilled to announce that Velas has extended its cross-chain interoperability by enabling bridging to Avalanche, a prominent blockchain platform known for its high throughput and low fees.

Technology, Engineering 1 min reading

Smart Contracts on SteroidsWelcome to the latest edition in our series, Exploring Velas' Innovative Technologies. Throughout this series, we delve into the cutting-edge technologies propelling Velas forward as a leading blockchain platform, reshaping the landscape...

Velas is a blockchain platform that is very effective and scalable. It has gotten a lot of attention in the cryptocurrency and blockchain communities. One of Velas' key differentiators is its focus on development tooling. In this article, we will compare the development tools for Velas and Solana, another popular blockchain platform. We will look at the features and capabilities of each platform and compare how easy they are to use, how flexible they are, and how well they work overall. By the end of this article, you should have a good understanding of the strengths and weaknesses of Velas and Solana as development tools and be able to make an informed decision about which platform is the best fit for your needs.

Protocol Differences:

Velas leverages the various features of Solana's architecture, and it has added several developer-friendly features from the Ethereum Virtual Machine (EVM). This lets developers use tools like Solidity and Hardhat while still taking advantage of Solana's core features. Velas' network can process more than 50,000 transactions per second, making it the fastest among EVM chains. Additionally, Velas has significantly lower transaction fees, around $0.00001, compared to Solana. Solana has a similar transaction throughput but slightly higher fees.

Smart Contracts:

All Solana smart contracts (also known as programs) are written in Rust, C, or C++. Most Solana developers use Rust for its built-in security features and ease of use compared to C or C++. Rust is a low-level, multiparadigm programming language.

Velas is EVM compatible, so developers working on Velas use Solidity. Solidity is the most commonly used language for smart contract development and is designed to run on the EVM. Solidity is an object-oriented, high-level, statically typed language

When comparing solidity and rust, there are advantages and disadvantages to each. If you choose to work with Solana and Rust, you can expand your skills beyond blockchain development because Rust is a general-purpose programming language. Rust is particularly useful in WASM-based applications. On the other hand, Solidity is only focused on smart contract development and can only be used on the EVM.

Common Development Tools:

While Velas' architecture shares similarities with Solana, it has also incorporated unique features from the Ethereum Virtual Machine (EVM) to make it more developer-friendly. The platform aims to provide an enhanced experience for developers and users by leveraging the high transaction processing speed of Solana and the functionalities of EVM. Velas' compatibility with the EVM allows for a wider range of tooling options, making it more accessible and versatile for developers to build and deploy decentralized applications.

Deployment and Testing Framework:

Many Solana developers use Anchor as a development framework. Anchor is a comprehensive tool for Solana smart contract development, providing boilerplate code for common actions such as the (de)serialization of accounts and instruction data. It also includes a testing framework to aid in development.

Velas, being EVM compatible, has a range of tools available to developers, including Hardhat and Truffle. Both of these tools are comprehensive development suites for Solidity smart contract development. Hardhat has released two major versions, while Anchor is still in continuous development. This may be a consideration for developers, as they may need to keep up with the development of Anchor.

Wallets:

Solana has a strong wallet ecosystem, with Phantom leading the market. The Solana wallet ecosystem is continually growing and innovating on existing infrastructure.

Velas has developed its own wallet and is currently working on a new one, set to be released in early 2023. Both wallets will provide a solid foundation for the Velas ecosystem and its users, which is enhanced by the ability to use EVM-compatible wallets. Additionally, the Velas wallet has staking functionality that is not provided by other EVM compatible wallets, making it a unique and valuable option for users within the Velas ecosystem looking to stake their assets..

Front End Tools:

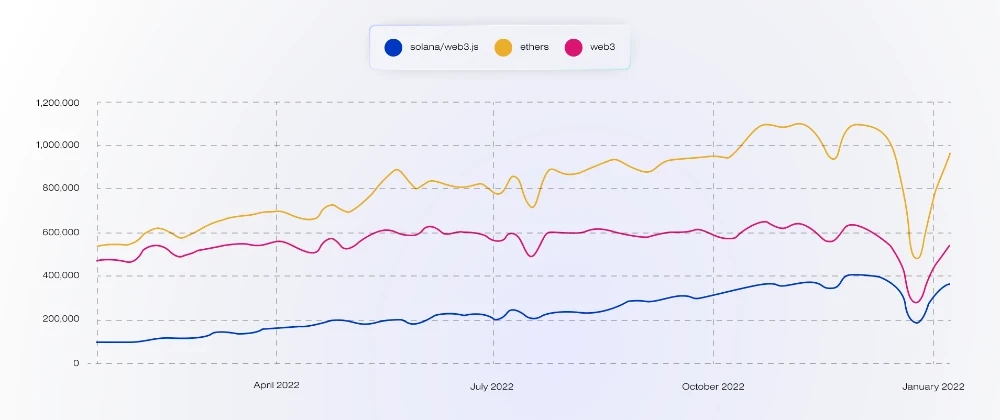

To build a frontend that interacts with Velas, you can use libraries such as web3.js or ethers.js. These libraries work with Velas and any EVM chain. This makes it easy to add Velas to an application that already works with EVM. Solana uses its own solana/web3.js library, which has similar functionality but only supports Solana.

When comparing solana/web3.js with ethers.js or web3.js, the latter options are typically more stable and widely used by developers. You can check the usage of these libraries on npmtrends to see which ones are most popular among developers.

Security Analysis:

For security analysis of smart contracts, we will examine available static analysis tools. Velas offers a range of static analysis tools, such as Slither and Echidna. Solana is a relatively new ecosystem, so you may not find as many sophisticated tools like Slither. But there are resources where you can find information about common exploits and how to stop them.

DeFi Building Blocks:

When making applications for any layer-1 protocol, it helps to have basic DeFi infrastructure to make the user experience better. These building blocks include automated market makers (AMMs), and bridges.

Automated Market Makers:

Many applications have tokens for rewards, governance, etc. When users need to trade these tokens, they will require AMMs. As a result, AMMs are a key building block for any layer 1 ecosystem.

Solana has a number of AMMs with high trading volume and activity, including Orca, Raydium, and Saber. Velas ecosystem AMMs include WagyuSwap, Wavelength DAO, and AstroSwap, with WagyuSwap leading the pack. KyberSwap, which is one of the top DEX aggregators, also supports Velas.

Bridges:

Users who have tokens on other chains and want to bring them to layer 1, where your application is deployed, will need bridges. Wormhole is a popular bridge on Solana that allows a wide range of tokens to be bridged to Solana. Other options for bridging assets to Velas include AnySwap, which allows users to bridge assets from a variety of layer 1s to Velas.

How will the Velas team help you migrate to Velas?

In this article, we have reviewed the technical differences between Solana and Velas to help you decide which protocol is the best fit for your application. The Velas team also offers a grants program to help developers building on Velas with various resources such as recruiting, networking, marketing, etc.

Stay ahead of the curve

Add your email to get hand-tailored messages only. We say no to boring newsletters and spam!